Accounting for Advertising & Marketing Agencies

Keep track of all expenses, invoices, and receipts, as they can be used for tax purposes or audited by the bank when applying for loans. Moreover, it is advisable to keep separate records for different projects to better understand how much time and resources are allocated to each project. The two types of bookkeeping systems most often used by marketing agencies are cash and accrual accounting. When an agency is calculating its income, cash accounting considers the revenue received at that moment.

Finally, use the analytics that come with your digital tools to track your results in real time. Firms that track multiple metrics have a relatively high level of control over their marketing program. Many metrics come baked into accounting for marketing agency your tools, while others (such as conversion goals, link tracking, UTM codes and filters in Google Analytics) need to be set up in advance. If you don’t track your progress, you’ll be little better off than Mr. Wanamaker.

Real-time Project Management:

Managing or owning a business, especially within the marketing agency sector, focuses on the… Partnering with financial experts like Fusion CPA can provide the guidance and solutions needed to navigate these challenges and unlock your agency’s full potential. Don’t let financial uncertainty hold your agency back—let Fusion CPA be your partner in financial success. You now know everything there is to know about bookkeeping for marketing agencies.

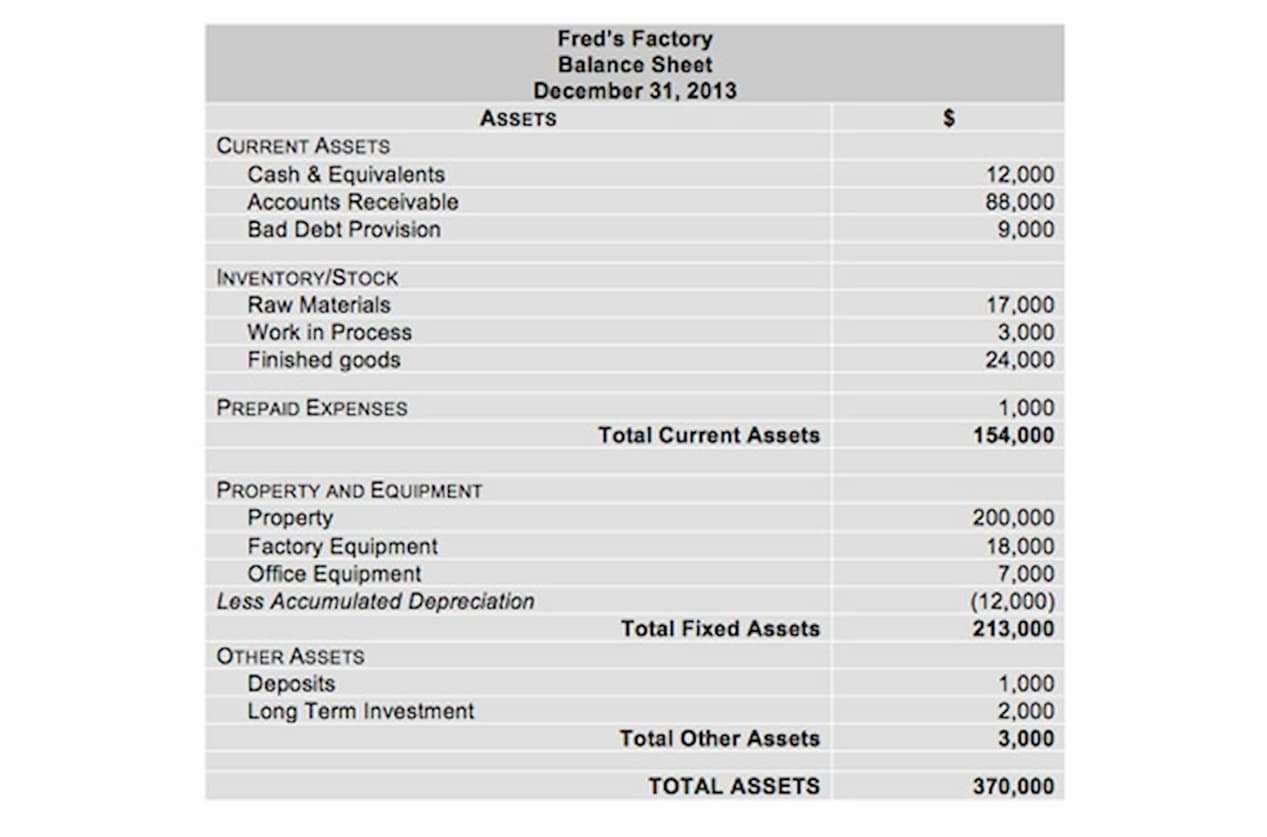

In reality, your agency might not carry an accounts payable balance if it pays most of its bills with a credit card. If your agency pays suppliers using payment terms, then it’s important to track payables in its accounting system. An agency recognizes deferred revenues when a client pays in advance for services not yet rendered. Examples of deferred revenues include pro-forma, upfront, and retainer payments. A large receivables balance could indicate trouble collecting payments from clients, so monitoring receivables in your accounting system will help prevent cash flow issues. Categorizing transactions involves assigning each transaction to the appropriate account in your chart of accounts.

Introduction – Accounting and Marketing Agency

In the dynamic world of marketing, unforeseen expenses can crop up at any moment. These could be technology glitches, sudden market changes, or client demands that deviate from the original scope. Failing to plan for these unexpected costs can lead to budget overruns and strained client relationships.

- Investing in cloud-based accounting software can significantly cut down on the tedious data entry of manual accounting.

- This detailed statement should encompass all office revenue generated from marketing campaigns and media dealings.

- Using tools like accounting software allows easy categorization between direct campaign-related costs versus general administrative overheads.

- ROI or Return on Investment is a common way to measure the success of a marketing agency’s campaign.

- You can’t afford to slack off on record-keeping – it’s crucial to keep your marketing agency running smoothly!

Commingling funds can have severe legal and tax implications and pose a significant accounting challenge. It’s crucial to maintain a clear separation between personal and business finances to avoid these pitfalls. Conversely, when a refund is due, the agency credits the advertising expense account and debits the vendor’s account.

Proven technology for your business

You’ll need to match bank deposits to client payments or a batch of client payments. You’ll also need to match vendor bill payments, whether those are cleared checks or electronic payments, to open bills in the accounting system. If your client data lives in a CRM or project-management software, which you also use for invoicing, then you don’t need to duplicate data between the two systems.